Peter Lobner

In 2015, I compiled the first edition of a resource document to support a presentation I made in August 2015 to The Lyncean Group of San Diego (www.lynceans.org) commemorating the 60thanniversary of the world’s first “underway on nuclear power” by USS Nautilus on 17 January 1955. That presentation to the Lyncean Group, “60 years of Marine Nuclear Power: 1955 –2015,” was my attempt to tell a complex story, starting from the early origins of the US Navy’s interest in marine nuclear propulsion in 1939, resetting the clock on 17 January 1955 with USS Nautilus’ historic first voyage, and then tracing the development and exploitation of marine nuclear power over the next 60 years in a remarkable variety of military and civilian vessels created by eight nations.

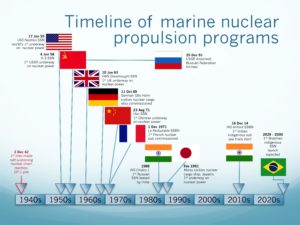

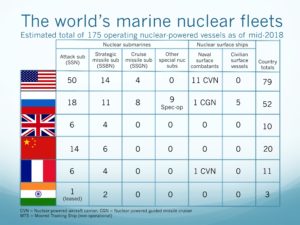

Here’s a quick overview of worldwide marine nuclear in 2018.

Source: two charts by author

Source: two charts by author

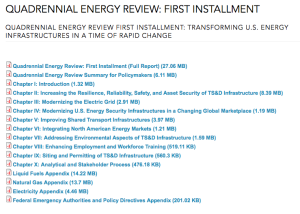

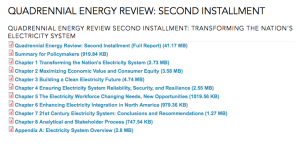

In July 2018, I finished a complete update of the resource document and changed the title to, “Marine Nuclear Power: 1939 –2018.” Due to its present size (over 2,100 pages), the resource document now consists of the following parts, all formatted as slide presentations:

- Part 1: Introduction

- Part 2A: United States – Submarines

- Part 2B: United States – Surface Ships

- Part 3A: Russia – Submarines

- Part 3B: Russia – Surface Ships & Non-propulsion Marine Nuclear Applications

- Part 4: Europe & Canada

- Part 5: China, India, Japan and Other Nations

- Part 6: Arctic Operations

The original 2015 resource document and this updated set of documents were compiled from unclassified, open sources in the public domain.

I acknowledge the great amount of work done by others who have published material in print or posted information on the internet pertaining to international marine nuclear propulsion programs, naval and civilian nuclear powered vessels, naval weapons systems, and other marine nuclear applications. My resource document contains a great deal of graphics from many sources. Throughout the document, I have identified the sources for these graphics.

You can access all parts of Marine Nuclear Power: 1939 – 2018 here:

Marine Nuclear Power 1939 – 2018_Part 1_Introduction

Marine Nuclear Power 1939 – 2018_Part 2A_USA_submarines

Marine Nuclear Power 1939 – 2018_Part 2B_USA_surface ships

Marine Nuclear Power 1939 – 2018_Part 3A_R1_Russia_submarines

Marine Nuclear Power 1939 – 2018_Part 3B_R1_Russia_surface ships & non-propulsion apps

Marine Nuclear Power 1939 – 2018_Part 4_Europe & Canada

Marine Nuclear Power 1939 – 2018_Part 5_China-India-Japan & Others

Marine Nuclear Power 1939 – 2018_Part 6 R1_Arctic marine nuclear

I hope you find this resource document informative, useful, and different from any other single document on this subject. Below is an outline to help you navigate through the document.

Outline of Marine Nuclear Power: 1939 – 2018.

Part 1: Introduction

- Quick look: Then and now

- State-of-the-art in 1955

- Marine nuclear propulsion system basics

- Timeline

- Timeline highlights

- Decade-by-decade

- Effects of nuclear weapons and missile treaties & conventions on the composition and armament of naval fleets

- Prospects for 2018 – 2030

Part 2A: United States – Submarines

- Timeline for development of marine nuclear power in the US

- US current nuclear vessel fleet

- US naval nuclear infrastructure

- Use of highly-enriched uranium (HEU) in US naval reactors

- US submarine reactors and prototype facilities

- US Navy nuclear-powered submarines

- Nuclear-powered fast attack submarines (SSN)

- Submarine-launched torpedoes, anti-submarine missiles & mines

- Systems to augment submarine operational capabilities

- Nuclear-powered strategic ballistic missile submarines (SSBN)

- Submarine-launched strategic ballistic missiles (SLBMs)

- Nuclear-powered guided missile submarines (SSGN)

- Cruise missiles and other tactical guided missiles

- Nuclear-powered special operations submarines

- Nuclear-powered fast attack submarines (SSN)

Part 2B: United States – Surface Ships

- US naval surface ship reactors & prototype facilities

- US Navy nuclear-powered surface ships

- Evolution of the US nuclear-powered surface fleet

- Nuclear-powered guided missile cruisers (CGN)

- CGN tactical weapons

- Nuclear-powered aircraft carriers (CVN)

- Carrier strike group (CSG) & carrier air wing composition

- Naval nuclear vessel decommissioning and nuclear waste management

- US civilian marine nuclear vessels and reactors

- Operational & planned civilian marine vessels and their reactors

- Other US civilian marine reactor designs

- Radioisotope Thermoelectric Generator (RTG) marine applications

- US marine nuclear power current trends

Part 3A: Russia – Submarines

- The beginning of the Soviet / Russian marine nuclear power program

- Russian current nuclear vessel fleet.

- Russian marine nuclear reactor & fuel-cycle infrastructure

- Russian nuclear vessel design, construction & life-cycle infrastructure

- Russian naval nuclear infrastructure

- Russian nuclear-powered submarines

- Submarine reactors

- Nuclear-powered fast attack submarines (SSN)

- Submarine-launched torpedoes & anti-submarine missiles

- Strategic ballistic missile submarines (SSB & SSBN)

- Submarine-launched ballistic missiles (SLBM)

- Cruise missile submarines (SSG & SSGN).

- Cruise missiles

- Nuclear-powered special operations subs & strategic torpedoes

- Other special-purpose nuclear-powered subs

- Examples of un-built nuclear submarine projects

Part 3B: Russia – Surface Ships & Non-propulsion Marine Nuclear Applications

- Russian nuclear-powered surface ships

- Surface ship reactors

- Nuclear-powered icebreakers

- Nuclear-powered naval surface ships

- Nuclear-powered guided missile cruisers

- Nuclear-powered command ship

- Nuclear-powered aircraft carrier

- Nuclear-powered multi-purpose destroyer

- Russian non-propulsion marine nuclear applications

- Small reactors for non-propulsion marine nuclear applications

- Floating nuclear power plants (FNPP)

- Transportable reactor units (TRU)

- Arctic seabed applications for marine nuclear power

- Radioisotope Thermoelectric Generators (RTG)

- Marine nuclear decommissioning and environmental cleanup

- Russian marine nuclear power current trends

Part 4: Europe & Canada

- Nations that operate or have operated nuclear vessels

- United Kingdom

- The beginning of the UK marine nuclear power program

- UK current nuclear vessel fleet

- UK naval nuclear infrastructure

- UK naval nuclear reactors

- UK Royal Navy nuclear-powered submarines

- Nuclear-powered fast attack submarines (SSN)

- Submarine-launched tactical weapons

- Nuclear-powered strategic ballistic missile submarines (SSBN)

- Submarine-launched ballistic missiles (SLBM)

- Nuclear-powered fast attack submarines (SSN)

- UK disposition of decommissioned nuclear submarines

- UK nuclear surface ship and marine reactor concepts

- UK marine nuclear power current trends

- France

- The beginning of the French marine nuclear power program

- French current nuclear vessel fleet

- French naval nuclear infrastructure

- French naval nuclear reactors

- French naval nuclear vessels

- Nuclear-powered strategic ballistic missile submarines (SNLE)

- Submarine-launched ballistic missiles (MSBS)

- Nuclear-powered fast attack submarines (SNA)

- Submarine-launched tactical weapons

- Nuclear-powered aircraft carrier

- Nuclear-powered strategic ballistic missile submarines (SNLE)

- French disposition of decommissioned nuclear submarines

- French non-propulsion marine reactor applications

- French marine nuclear power current trends

- Germany

- United Kingdom

- Other nations with an interest in marine nuclear power technology

- Italy

- Sweden

- Netherlands

- Canada

Part 5: China, India, Japan and Other Nations

- Nations that have operated nuclear vessels

- China

- The beginning of China’s marine nuclear power program

- China’s current nuclear vessel fleet

- China’s naval nuclear infrastructure

- China’s nuclear vessels

- Nuclear-powered fast attack submarines (SSNs)

- Submarine-launched tactical weapons

- Nuclear-powered strategic ballistic missile subs (SSBNs)

- Submarine-launched ballistic missiles (SLBMs)

- Floating nuclear power stations

- Nuclear-powered surface ships

- Nuclear-powered fast attack submarines (SSNs)

- China’s decommissioned nuclear submarine status

- China’s marine nuclear power current trends

- India

- The beginning of India’s marine nuclear power program

- India’s current nuclear vessel fleet

- India’s naval nuclear infrastructure

- India’s nuclear-powered submarines

- Nuclear-powered fast attack submarines (SSNs)

- Submarine-launched tactical weapons

- Nuclear-powered strategic ballistic missile submarines (SSBNs)

- Submarine-launched ballistic missiles (SLBM).

- Nuclear-powered fast attack submarines (SSNs)

- India’s marine nuclear power current trends

- Japan

- China

- Other nations with an interest in marine nuclear power technology

- Brazil

- North Korea

- Pakistan

- Iran

- Israel

- Australia

Part 6: Arctic Operations

- Rationale for marine nuclear power in the Arctic

- Orientation to the Arctic region

- US Arctic policy

- Dream of the Arctic submarine

- US marine nuclear Arctic operations

- UK marine nuclear Arctic operations

- Canada marine nuclear ambitions

- Russian marine nuclear Arctic operations

- Russian non-propulsion marine nuclear Arctic applications

- China’s marine nuclear ambitions

- Current trends in marine nuclear Arctic operations

Periodic updates:

- Parts 3A and 3B, Revision 1, were posted in October 2018

- Part 6, Revision 1, was posted in February 2019